Since Windows 2000 Microsoft always screwed up the next release. ME, Vista and eventually God forsaken Windows 8. By their own admission it was so bad they tried to salvage it with 8.1 and gave us Server 2012 which still plagues too many data centers to this day. Everyone eventually accepted an increasingly stable Windows 10 and it may remain the gaming platform of choice for quite some time, it’s hardware empire is vast. What less did we expect of Microsoft but to force upon us a release as necessary and comfortable as a moment of lockjaw. But hold on. Windows 11 doesn’t suck.

I’m running the Developer release, an in-place Win 10 update, on my Lenovo X1 Carbon with an 8th Gen Core-i7 and 32Gb of RAM. It’s got quite an engine under the hood to ride on. I suspect older machines may require a full wipe and clean install instead of an update. It won’t load on 32-bit hardware, only 64. Which is cool because we don’t need to stop the 2-3 year technology fold just because a few Gen-X dads now hitting our 50s are getting comfortable and complacent. Charge on boys.

The good, the bad and the bad-ass.

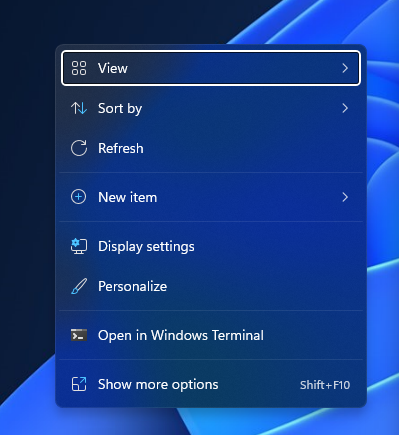

There are several good things about Windows 11, some more functional and others more aesthetic. One right click on the desktop and the aesthetics of the menu differences are glaring, better, modern and clean.

The new Start menu location has cause some controversy. Yes, Apple did it first. Does that make it wrong for Microsoft to do it now? I’ve been using Windows since version 3.1, code named “Sparta”, in 1992 and I never found the lower left corner appealing, always annoying. Others claim ramming the mouse into that corner is easier than focusing on the center of the task bar. You can put it back over there if you want. It makes a lot more sense to me in the middle. I’m not a Mac user, it just makes more sense and I say good call. Fight me.

The right click options are not laid our the way they used to be and using a button to “Copy” instead of clicking the word “Copy” took some getting used to. And there’s no “Send To” option anymore. But again, that’s all aesthetics without any real change in functionality. Interesting the “Share with Skype” option remains on the menu even though Skype is deprecated.

I’ve only found a couple of things that can be classified as “bad” so far and they are really just glitches in development, likely to be fixed before any consumer release.

- Clicking on the clock in the lower right corner near the task manager causes a screen refresh before the calendar and date/time settings can be pulled up.

- If I right click on the Desktop and choose “Display Settings” and then navigate to “System” it lists all system settings, as it should. However if I then right click on the desktop and choose “Display Settings” again, it now takes me to “System” settings or the last place the System settings menu was left.

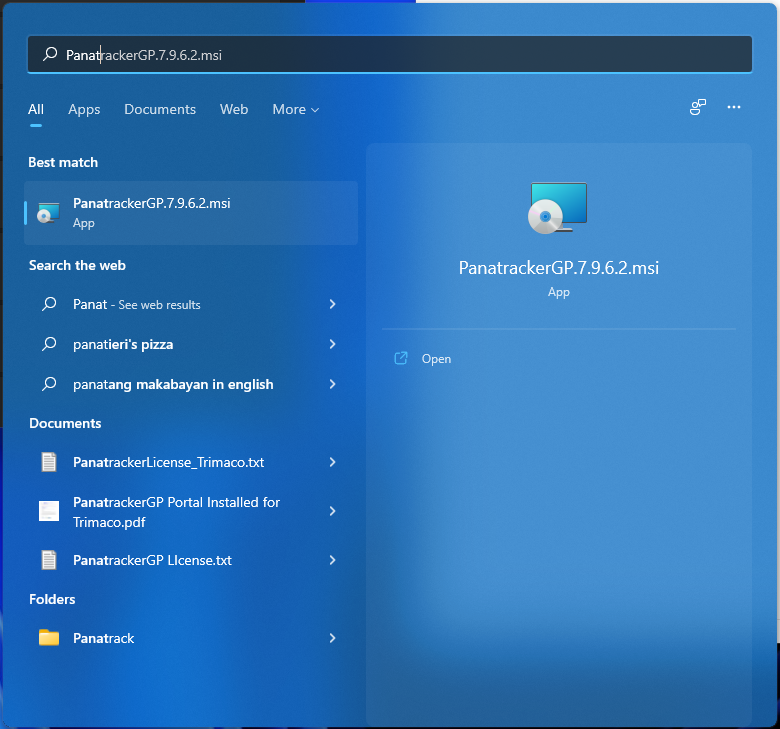

The bad-ass search. Wow. Apparently this update is indexing every bit of every byte on the hard drive during install because the search is FAST. And it works. Anyone who remembers how pathetic and horrifying the search function was in Windows 8 knows how much work the kids in Redmond had in front of them. Unless they somehow screw it up before release this will be the most talked about and potentially most functional component of the OS. It’s almost easier to search for something than to find it on a myriad of desktop icons or “recent” files in app cache.

So far, so good. It’s really stable even under development. No video, network or Bluetooth issues so far and regardless of it’s blatant similarities to Mac OSx the new, more elegant look is long over due.