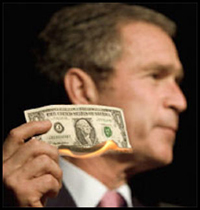

And now the US government is encouraging mergers between institutions that have been deemed “too large to fail”. Once upon a time we relied on things known as antitrust laws to prevent this. These were not only meant to make companies spur competition and diversity, keep them from growing so large that their failure would be detrimental to the economy as a whole but also keep them from gaining too much political power and influence. Just listen to the Republicans rant about the “average Joes”, who are nowhere near average with incomes above $250K per year, and you can understand where the current complacency regarding the aggregation and concentration of wealth comes from.

This excessive greed and sense of entitlement on the part of the wealthy in America is specifically what got us into our current economic crisis. The argument from the wealthy is that anything less is “socialism”. This is far from the truth. For every law that has been passed in the name of consumer protection or to stop the aggregation of companies beyond a level considered tolerable to maintain a functional economy there has been an army of lawyers ready to find the loopholes in these laws so that powerhouse mergers can continue. Large corporations like the idea of being able to buy the competition instead of actually competing against them with superior products and services. It’s become the Corporate American standard.

And now the government has entered the business of negotiating and mandating these mergers through the Federal Reserve. They are also funding non-financial companies deemed “too large to fail”, which did anyway. This is not just a slippery slope. It’s a triple diamond run covered in Crisco. There’s a real problem on the horizon here. In the case of a fine, fee or public protection issue from these institutions who do we think is going to protect the consumer? Regardless of how damaging one of these institutions actions may be for many Americans the government will let them press ahead if it means a “return for the tax payer”, which sounds a lot like “return for the share holder”. And we all know share holder returns trump everything when it comes to corporate policy.

I’d like to know exactly how spending the tax dollars of future generations to bail out companies, that may or may not result in a return, benefits the tax payer at all. In the future it will help build more military equipment? Will it help build more highways? I got news: Those things would be done anyway using the same pretend money that was used to bail out the institutions that were “too big to fail” in the first place. Sucker.