The fundamental question has not been answered. This doesn’t take rocket surgery or complex micro-economic theory:

The fundamental question has not been answered. This doesn’t take rocket surgery or complex micro-economic theory:

Investors realize that even if the banks started lending right now, today, who among us can afford to borrow? The majority of American’s cannot afford to pay the bills they have.

Deal with it banks. Your days of profiteering on ridiculous interest rates and terms are done. Citi Group and Wells Fargo are fighting over the Wachovia carcass. By the time the run on deposits is over the only thing left will be the skeleton.

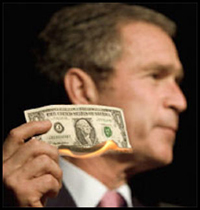

What’s the difference between today and Friday? Friday the country was $700 billion richer. Thank you sir may I have another! And this time kiss us first.

I’m not sure if you watched 60 Minutes last night or not, but there was a very enlightening story about this whole financial mess. Here is a clip from that story:

“This is a full-blown financial storm and one that comes around perhaps once every 50 or 100 years. This is the real thing,” says Jim Grant, the editor of “Grant’s Interest Rate Observer.”

Grant is one of the country’s foremost experts on credit markets. He says it didn’t have to happen, that this disaster was created entirely by Wall Street itself, during a time of relative prosperity. And they did it by placing a trillion dollar bet, with mostly borrowed money, that the riskiest mortgages in the country could be turned into gold-plated investments.

“If you look at how this started with the subprime crisis, it doesn’t seem to be a good bet to put your money behind the idea that people with the lowest income and the poorest credit ratings are gonna be able to pay off their mortgages,” Kroft points out.

“The idea that you could lend money to someone who couldn’t pay it back is not an inherently attractive idea to the layman, right. However, it seemed to fly with people who were making $10 million a year,”

The investment companies (Lehman Brothers, Bear Sternes, AIG) purchased these subprime loans from the lenders and sold them as investments, and also offered guaranteed returns (something like insurance) to the investors. When the loans started going south, they ran out of money paying the investors.

I know you hate banks…you’ve made that clear…but they are not solely responsible for the mess we are in today. Wall Street made this mess.

Wall Street is Investment banking, Wachovia, BOA and their consumer branch assets are Institutional banks. They are regulated under different sets of laws. That said, Wachovia and WaMu are gone for the same underlying reason that Lehman Bros. and Bear Stearns are gone: bad mortgage backed securities and the loss write-off’s incurred.

Many, many different types of investments are traded on Wall Street, not just financial security packages. Investment BANKS on Wall street lost when they bundled bad mortgage backed securities with other bonds and resold them to investors. When the bad mortgage securities part of the bundle went south the other bonds in the package soured as a whole. These bad loans originated, guess where? At Institutional banks like WaMu and Wachovia (plus Countrywide financial, First Franklin and other sub-prime mortgage underwriters).

The banks are in this together. The ones who originated the bad loans and the the ones on Wall Street who bought and bundled them. But this doesn’t mean that Wall Street is bad. Unless you want to characterize Wall Street as being nothing but Investment banks. I trade stock through an on-line brokerage that has nothing to do with an investment bank. And a lot of investors didn’t buy any hedge funds or mutual funds that included mortgage backed securities.

The problem I have is that even though many investments don’t include any bundled securities the stocks are still taking a hit because of the uncertainty in the market. Everyone just needs to calm down. And yes I do think the banks need to be paying the heaviest price. It doesn’t matter if they are headquartered in Charlotte or New York they share responsibility in the origin of this calamity.

And for the record, I do have some sympathy for bank employees at the branch level. Your typical teller or branch manager probably had little knowledge or responsibility for any of the greedy action being taken by high level executives. And they have the most to lose. Strong branch banks with a ton of depositors are the only safe ones now. And as long as an Institutional bank isn’t writing off millions or billions in mortgage defaults and can avoid a run on deposits they should be just fine.